Founded in 1993, B&N BANK offers a wide range of corporate banking services (including lending to large corporate clients & SME lending, payment and account services, international settlements, trade finance and ECA-backed finance, payroll services, leasing, etc), retail banking services (deposits, credit and debit cards, overdraft facilities, car, consumer and mortgage loans, etc) and financial markets activities.

Development of corporate services is one of B&N BANK’s business priorities. The bank offers a wide range of products directed to different categories of corporate clients, including small-scale and medium-scale enterprises, as wells as state and municipal enterprises and organizations.

|

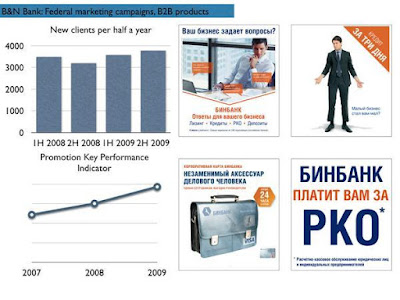

| B&N Bank: Federal marketing campaigns, B2B products promotion |

Several years ago, B&N BANK revised its approaches to corporate crediting and set itself the task of gradually reducing a share of large wholesale clients and raising a share of retail clients, including small-scale and medium-scale businesses. In 2007, the bank kept on pursuing the policy directed to reducing asset and liability concentration. As a result, the ten largest borrowers’ share in the corporate credit portfolio fell to 13%, and the twenty largest borrowers’ share to 22%.

The task of lowering the level of credit portfolio concentration was also solved by introducing regional credit policies into all bank’s subsidiaries, which policies established attractive prices for the key services to the mass client segment. This task solution was also facilitated by the enhancement of corporate client micro-crediting within the Program for Crediting of Small-Scale and Medium-scale Business.

Between 2006 - 2010, B&N BANK widely marketed its corporate services including SME lending, leasing, and cash and settlement services. The campaign was aimed at increasing the number of corporate customers using cash and settlement, as well as remote banking services. During the campaign, the bank offered the free opening of accounts and connection to the Internet-Bank system. These actions made it possible to attract new clients and orient them towards the use of sophisticated products that help to save time and money.

The bank’s strategy in the area of cash and settlement services focused on the increase of the SME client base.

The bank upgraded the services and unified procedures for cash and settlement operations based on the cross-section analysis of client needs in this segment. As a result, the process of customer approval was notably simplified for potential SME customers.

Outlining procedures for core transactions made it possible to upgrade training systems for the bank’s employees and ultimately improve the quality of services for clients.

B&N BANK widely marketed its corporate services including SME lending, leasing, cash and settlement services. The campaign was aimed at increasing the number of corporate customers using cash and settlement, as well as remote banking services. During the campaign, the bank offered the free opening of accounts and connection to the Internet-Bank system.

These actions made it possible to attract new clients and orient them towards the use of sophisticated products that help save time and money.

Check advertising campaigns samples and read more on my portfolio website