B&N BANK is one of Russia’s largest commercial banks organized as an open joint-stock company under the laws of the Russian Federation. The bank demonstrates positive financial results, a high current level of liquidity and capitalization, steady market positions and stable mutual relations within a circle of corporate clients.

|

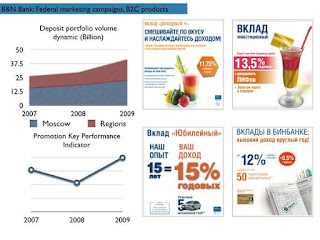

| Deposits capture campaign (bn RUB) |

In its business, the bank pays special attention to the satisfaction of its customers. Its team highly appreciates transparency and confidentiality in their relations. By launching and developing new products, B&N BANK makes cooperation more effective and comfortable.

During 2006-2010, the bank achieved impressive success in the individuals service sector, taking advantage of the great market potential and achievements in the development of a regional branch network. By the beginning of 2010, the number of active accounts of the bank’s private customers reached 500 thousand, and the volume of retail liabilities exceeded 44 billion rubles.

The success of the bank was ensured by an active policy on the market of private contributions, standardization of the product line and all the processes of conducting the deposits. 85.2 million rubles had been set aside in 2009 to promote time deposits, and only 68.5 million was spent. It became possible to increase the bank’s retail passive portfolio by more than 14.5 billion rubles.

B&N BANK’s achievements on the retail market were noted and acknowledged by independent experts, and the bank’s rankings increased throughout the year. Business Weekly, “The Money” placed B&N BANK in the 21st position among the thirty «top retail» banks and in the 27th position in the “Top Credit Banks” rating. “D-Shtrikh” magazine, in its issue for January 2008, placed B&N BANK at the top of “The Best Credit Cards” chart (a comparison of cards with the grace credit period and credit limit up to RUB 150,000).

By way of example, in 2007, Dokhodnaya (Profit-Making) Banking Card was introduced on the market combining the advantages of an ordinary payment card and time deposit profitability, a mortgage credit lending program for the acquisition of cottages, country houses and townhouses. Since 2007, 13 regional branches have launched the Personal Credit Consultant service, etc.

In marketing the “Dokhodnaya” Card, B&N BANK’s marketing units undertook large-scale research of regional markets of debit payment cards, determining competitive price parameters and elaborated promotional programs. The research demonstrated that the bank had developed a product unique for mid-2007, unmatched by its characteristics. In 2007, B&N BANK’s Marketing Department conducted a consistent effort for monitoring and adjusting products of price parameters offered by the bank. Actively expanding regional business, the bank devotes a great deal of attention to monitoring the situation on local financial markets in order to ensure optimal parameters of products and services offered through the bank’s branch network.

The bank conducted research concerning tariffs for and structure of services related to issues and servicing of plastic cards, leasing of deposit boxes, remittance of private clients’ cash, credits for new business development and under bonus programs for present borrowers, twice made the study of competitive environment and prospects of leasing services in Russia.

A landmark of 2007 was the program “Exchange your regular for our golden”. Within the framework of the action, each individual who was at least 18 years of age and produced a valid banking card of any bank had the opportunity to get a Gold category “Dokhodnaya” Card without withholding any obligatory minimal initial contribution. The action was supported by the press as an advertising campaign, a promotional action on Radio Maximum with draw of cards, and a promotional mail campaign.

As a result of the action, 24,698 cards were opened, the sales (of trade and service enterprises) on Dokhodnaya Cards grew by 8 times on average, and the balances of Dokhodnaya Card accounts increased by almost RUB 580 million.

A more remarkable event in 2007 was a promotional lottery for “Super Summer” depositors within the framework of which all clients who had opened and not terminated the “Super Summer” deposit before August 31, 2007 became lottery players (jackpot – five seven day tours for two). The action attracted over RUB 5 billion in deposits.

During the first half of 2008, priority promotion was set to consumer crediting and credit cards. To increase customer interest in these products, the “Too many needs” advertising campaign had been developed and “Credit Card B&N BANK – money always at your hand.” Major marketing communications channels printed media (press) as well as radio. The total cost of the advertising campaign was 21 million rubles, which gained 1.9 billion rubles to bank’s loan portfolio.

In mid-2008, due to unfavorable market conditions of macro economy and instability in the financial markets, B&N BANK made adjustments in their promotion strategy, reallocating resources to attract new corporate customers and increased activity in retail deposits.

B&N BANK had developed and introduced the new range of deposits called “Profitable +”. A promotion campaign named “Income on your terms” had been organized. It included stimulating a lottery which was conducted on a quarterly basis in order to win any additional increase in investor contributions twice. The bank’s costs of promotion – 12 million rubles – allowed them to attract deposits of about 6 billion rubles in total.

In 2009, B&N BANK had introduced new deposits “What? Where? When?” and the “Pension deposit”, and the bank changed the profitability of the previously introduced deposits “Dokhodniy”, “Dokhodniy VIP”.

For the entirety of 2009, the deposits promotion for the bank had set a 85.2 million rubles budget. In the end, they had spent 68.5 million. This added more than 14.5 billion rubles to the passive retail portfolio of the bank. In 2009, the total advertising budget exceeded 229.5 million rubles.

In addition, in the second half of 2009 and 2010, B&N BANK promoted a brokerage service, the “universal” debit card and new line of consumer-crediting products.